Hybrid Long-Term Care Insurance

When someone passes away suddenly, a conventional life insurance policy pays out the death premium to the beneficiaries. However, some insurance policies have riders that allow you to use the death payout to help you financially while you are still alive. Long-Term Care Insurance plans with a dual rider incorporate a Long-Term Care Insurance policy with a conventional life insurance policy known as Hybrid Long-Term Care Insurance. The payout can be used to pay for at-home services, such as home health care, as well as assisted living facility care, respite care, hospice care and nursing home stays. Should you never need care it will return all premiums to your family tax free in the form of life insurance.

While a Hybrid Long-Term Care Insurance policy is more expensive than Traditional Long Term Care Insurance, it can save you money in the long run because the premium is paid off for life with the choice of single, five or ten year payments. Hybrid long term care insurance can be an important aspect of estate planning for certain families. While not everyone will need care, if you plan to leave your wealth to your beneficiaries and can afford it, a hybrid long-term care insurance policy can help you from depleting your assets to pay for medical treatment just in case you do need care.

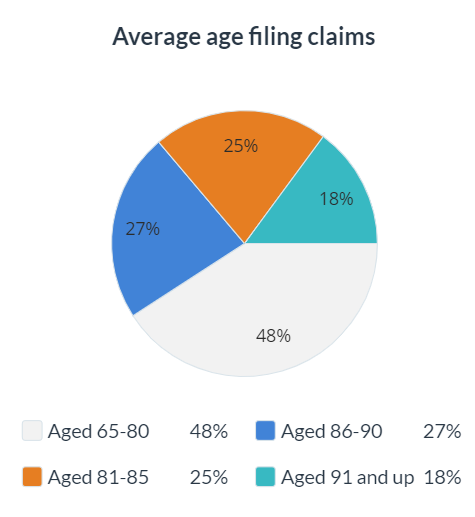

According to the US Department of Health and Human Services, more than half of Americans aged 65 and up will need some form of long-term care services at some point in their lives. The average age filing claims for long-term care services is approximately 86-90 (27%) with ages 81-85 falling just short of that (25%). This is an important statistic to take note of given that at age 65, you are eligible for Medicare and most are under the impression that Medicare will cover long-term care services. This is a common misconception about Medicare. Medicare does not cover long-term care services, it does cover up to 100 days of skilled nursing care if eligible, short term home health care provided you meet the criteria for qualified circumstances, and hospice care if you are in the last stages of life with your terminal illness. By the time most of us end up needing long-term care services, it is too late to retain a long term care policy and by that point, you might have to resort to applying for Medicaid, in which you will have to spend down all of your assets just to qualify thus leaving your beneficiaries with nothing.

While many people dislike standard Long Term Care Insurance policies and can’t get around the plans’ “use-it-or-lose-it” clause, they find comfort in knowing that Hybrid Long Term Care Insurance premiums result in high long-term care benefits and/or a death benefit paid to their beneficiaries. Standard long-term care insurance requires you to pay premiums for the rest of your life and only claim coverage if you need long-term care. Hybrid long-term care insurance on the other hand, offers guaranteed premium rates as well as guaranteed benefit rates and ensures your money back in the form of long-term care coverage or as a death benefit to your beneficiaries. This gives Hybrid insurance a leg up in the LTCI industry by providing assurance of a smart investment that will not only protect your assets but also provide protection to your beneficiaries from paying expenses incurred during your time of care.

Even if you exhaust all of your Long-Term Care benefits under a Hybrid Insurance policy, some companies such as Nationwide and Securian Financial, still offer a guaranteed base death benefit to your beneficiaries. This means that not only do you receive all the benefits for your health care needs, but your beneficiaries will still receive a death benefit

What is a Hybrid Long-Term Care Policy and How Does it Work?

Hybrid Long Term Care Insurance policies consist of a Whole Life Insurance policy combined with a Long-Term Care Insurance rider. These policies are designed to be more beneficial for individuals needing long-term care services and there fore do not offer high death benefits to your beneficiaries. However, your beneficiaries will receive a death benefit less and benefits used for long-term care services. You can use the Long Term Care Insurance benefits for home care, assisted living, adult day care and of course nursing home care. If you never need long term care services, the policy will return all premiums paid as a tax free death benefit to your beneficiaries. With some companies the premiums returned may even have some interest added, giving your beneficiaries slightly more than what you paid in.

Hybrid plans incorporate Whole Life Insurance and Long-Term Care Insurance, thus providing pay outs for long-term care services if you’re still alive and you need help with your activities of daily living. If you do indeed need long-term care, the funds used as a long-term care benefit are deducted from your Life Insurance benefit down to a policy minimum of approximately $10,000.

You must meet the insurer’s definition of injury or illness to be considered eligible to begin receiving your monthly long-term care benefits. This typically means you can no longer independently manage at least two of the six activities of daily living also know as ADL’s.

Here are the six ADL’s:

- Bathing

- Eating or drinking

- Getting dressed

- Moving from one place to another

- Using the restroom

- Maintaining bowel or bladder continence

Benefits of Hybrid Long-Term Care Policies

A combination Life Insurance Policy with Long-Term Care coverage is a newer alternative that offer peace of mind to you and your beneficiaries. Life Insurance and Long-Term Care Insurance are combined with these plans putting emphasis on the Long-Term Care benefits all while ensuring a death benefit even if you exhaust all of your Long-Term benefits.

A Hybrid Long-Term Care policy is advantageous in three ways:

- Benefits of Long-Term Care: When you need long-term treatment, you will have guaranteed benefits and use a portion of your life insurance policy’s death payout to help cover for medical and non-medical costs associated with daily care, such as eligible home care or assisted living. The better plans will pay these benefits in cash to spend any way you like. This will be stated as a cash indemnity rider on your policy and simply means that you will receive a check each month for the guaranteed approved monthly amount outlined in your monthly benefits selection, and you can spend this benefit as needed for cost of care as well as maintaining any bills that are being impacted during your time of care. Other policies, will have a reimbursement rider, meaning you will have to pay for costs up front and then supply the insurer with receipts for proof of care services and then they will reimburse you up to the monthly maximum benefit amount.

- Benefits for loved ones from life insurance: Unlike conventional long-term care plans, your loved ones will enjoy the life insurance payout if you never use the policy’s long-term care provisions. As well as a minimum death benefit should you exhaust all of your long-term care benefits. This is typically between 10 and 20 percent of your premium paid in.

- Benefits and premiums are guaranteed: Although hybrid policies are more costly up front than conventional long-term care policies, they offer guaranteed premiums and benefits once the policy is in place. This is a huge advantage when comparing to traditional policies because you never have to worry about possibly having to pay more in premiums and not being able to afford future policy increases and possibly losing your long-term care coverage all together. Many of us are aware of the economy changing and causing the cost of long-term care services to rise down the road, however, not all of us consider the possibility of the premiums themselves increasing due to inflation. With a hybrid policy, you will not have to worry about your premiums increasing.

Long-Term Care Insurance

Long-term care is a generic term for a wide variety of facilities that people will need whether they’re seriously ill or have disabilities. Services usually provide personal care or other facets of daily life, according to the Department of Health & Human Services.

Generally, people qualify to seek long-term care insurance coverage because they’re unable (temporarily or permanently) to independently perform at least two of the six activities of daily life. For example, the onset of a severe cognitive impairment, such as Alzheimer’s disease, may necessitate long-term care.

Choosing care can range from simply hiring someone to help you get ready in the morning at your own home, or paying for a nursing home or assisted living facility. Your care costs are determined by the services you require. According to national averages, a month of care can cost anywhere from $5,000 for home health care per month to nearly $10,000 for round-the-clock nursing facility care. A long-term care event typically lasts three to five years on average. These statistics not only vary by state but also by age, gender, and severity of your long-term care needs.

It can be difficult to pay for these services later in life as assets are depleted for regular living costs during retirement. Long-term care is not covered by health insurance. Part A of Medicare may cover a portion of the cost of a stay in a nursing home or rehabilitation center, but only for up to 100 days and only if the patient’s health is improving. In order to qualify for Medicaid, you must meet certain income and asset requirements.

The only remaining options are to pay for services with your savings or assets,

buying long-term care insurance or relying on family members for care.

The Value of a Hybrid Long-Term Care Insurance Policy

You must first determine whether long-term care insurance is appropriate for you before purchasing a policy. On the financial side, your financial advisor can explain how long-term care insurance fits into your overall financial plan, and provide some explanation on product availability as well as financial benefits it would serve in your estate planning. The other determining factor as to whether or not long-term care insurance is appropriate for you is if you genuinely believe you will require some form of long-term care services. Looking into your family’s health history as well as your current state of health is a great place to start your research. Besides knowing if you can afford long-term care insurance, you also want to know if you will even qualify for it. This product is not a guaranteed qualification and has a pretty extensive underwriting process that puts emphasis on your health and well being.

Hybrid life insurance policies with long-term care coverage are generally more expensive up front than traditional long-term care policies, but you’re guaranteed to get some value back. Recent sales figures also appear to indicate that more people are interested in hybrid long-term care insurance policies due to the traditional policy’s “use it or lose it” feature. Think of a hybrid policy as an investment, first prioritizing your health care needs, and second leaving a small nest egg to your loved ones.

An insurance industry marketing research firm stated the number of consumers purchasing a hybrid life insurance policy with long-term care coverage increased by 50% between 2012 and 2016 (the most recent data available). Traditional long-term care insurance sales fell by nearly 60% during the same time period.

A hybrid policy safeguards your family while also providing long-term care coverage in the event that you require it.

Other Advantages of Hybrid Life Insurance Over Traditional Long-Term Care Insurance Include:

The policy can be used to help with estate planning.

Loved ones can receive a partial or full death benefit from hybrid long term care insurance policy if care is never needed or just a small amount of care is used. The life insurance benefit is paid tax-free. Furthermore, long-term care insurance can help pay for medical expenses that would otherwise deplete the financial assets you hoped to leave to future generations.

It’s a straightforward way to set aside funds for long-term care.

Long-term care coverage is included in your policy if you need it. That coverage ensures that you can live the retirement lifestyle you want without worrying, “what if I need long term care?”. Keeping in mind that if you need long-term care, you won’t have to spend all or a large portion of your retirement savings on the care because you have a plan.

You will not have to pay insurance premiums for the rest of your life.

A hybrid long term care insurance policy can be paid in full up front, over five years or over ten years. These “multi-pay” plans may allow you to spread the cost of your policy over a period of time. After you’ve made those payments, you won’t have to make any more for the rest of your life. Traditional long-term care insurance policies, on the other hand, may require you to make annual payments for the rest of your life.

According to a 2015 study by Boston College’s Center for Retirement Research, more than one-fourth of people who buy traditional long-term care policies at age 65 eventually stop paying. When a policyholder stops paying premiums, regardless of how long they’ve had the policy, they lose all premiums paid in as well as their long-term care benefits. However, non-forfeiture options may be available as a rider for additional costs.

Your insurance policy has a set price.

The required premium amounts for hybrid long term care insurance are known up-front as they are set in the beginning and can’t be changed. Annual payments on traditional long-term care insurance are not guaranteed to remain constant and they may rise. One of the main reasons people stop paying their premiums and stop buying traditional long-term care insurance policies is due to unexpected rate increases.

You can get some of your money back if you change your mind.

Some hybrid life insurance policies provide a premium refund. If you decide that you no longer require or desire the policy, the insurer will refund a portion, or all depending on the policy, of your initial payment. The amount of your refund is determined by the rules of your insurance company and the length of time you’ve had the policy in place; however, the return of premium feature should be clearly stated in your insurance contract.

Indemnity Benefits

When you qualify for long-term care benefits, indemnity benefits set a monthly benefit amount and pay it in full. If you buy $5,000 per month in indemnity long-term care benefits but only have $3,000 in long-term care expenses per month, the policy will send you a check for the full $5,000 that month. You can spend the extra $2,000 in any way you want or set it aside in a savings account for any future medical services needed. An upside to this rider is that you have full control over your care costs, meaning you can even hire a family member to help care for you in the comfort of your own home; therefore cutting down on long-term care costs.

Reimbursement Benefits

Getting reimbursed once you qualify for long-term care benefits, you will be reimbursed only for the long-term care expenses you have incurred. In order to receive reimbursement, these expenses must be qualified and proven with all acquired receipts. This entails a lot more work and effort to receive care when compared to the indemnity option.

For example, if you purchase $5,000 per month reimbursement benefit but your long-term care expenses are only $3,000 per month, the company will reimburse you the $3,000 difference. The $2,000 you didn’t use that month will remain unused on your policy until the end of the benefit period. It can only be used for long-term care costs that are qualified by the insurer.

Who Should Consider a Hybrid Long-Term Care Policy?

One of every two Americans over the age of 65 will need some form of long term care assistance before they die. However, there are occasions where someone who is young and in good health will be unexpectedly injured and require long-term medical assistance. If you are retired, a hybrid long-term care plan will help you if you need care, or set your heirs up for financial success if you don’t need care. A hybrid policy will also alleviate most or all of your long-term care costs without completely depleting your financial assets, leaving you to enjoy your retirement without the constant worry of how to prepare for any unexpected medical costs.

A hybrid long-term care policy is easier to qualify for and attain a policy while you are younger because we are typically in better health. Something else to keep in mind about your age is that most long-term care insurers have an age limit of 70 years old thus limiting your options should you choose to wait to purchase a policy after that age. The risk of needing long-term care grows as you age. Regardless of cost, adding a long-term care rider to your life insurance policy could prove advantageous as you reach retirement. Also, even if you don’t use it for 30 to 40 years, buying a policy early will mean you get a good deal and don’t jeopardize your or your family’s financial security.

Since the costs of assisted living and health care are so high, it’s important to have a budgetary plan in place even before you need to pay for care. A hybrid long-term care insurance policy will provide coverage if and when you need it.